The Evolving Hong Kong Board & Advisory Ecosystem

Hong Kong's Board & Advisory space is changing, with regulatory developments impacting the likely structure and strategy of future board composition.

At ConnectedGroup we see that the future supply of talent will need to come from a more diverse range of backgrounds and experience to meet the needs of an evolving regulatory framework and rapidly changing economic landscape.

To clarify, there are 3 main types of formal board role categories in listed companies:

- Executive Directors – employees of the organisation in the senior leadership team, some of whom may sit in the board, usually the CEO or equivalent on the main board.

- Non-Executive Directors – board members who are not employees but who represent significant shareholding interests.

- Independent Non-Executive Directors – board members who are not employees and who have no other connection to the business.

It is the 3rd role of INED on which the regulatory changes focus. A very useful ‘Snapshot of INED’s Roles and Responsibilities’ produced by HKEX can be found here.

There are 2 key regulatory pressures:

1. Trimming the Seats: HKEX’s Push to Reduce Over-boarding

Recently, the Hong Kong Exchanges and Clearing (HKEX) has announced a proposal to limit the number of board roles an individual can hold across listed companies. While this number was not restricted in the past, the proposal is that an individual can only hold maximum of six board roles. This is an effort to ensure that the directors can devote sufficient time to each company. These changes will be implemented from 1st January 2025 with a proposed three-year transition period for the changes relating to INEDs. As reported by the South China Morning Post, the "over-boarding" proposal has sparked significant debate among company directors because the proposal would force them relinquish some of their roles.

At the end of 2023, 23 over-boarded INEDs served on the boards of 181 companies listed on the HKEX (approximately 7% of all HKEX-listed companies), and five INEDs held 10 or more listed company directorships. HKEX firmly believes that it will lead to positive outcomes as INEDs will demonstrate better performance for their board roles. At the end of the day, “Independent non-executive directors and other non-executive directors should make a positive contribution to the development of the issuer’s strategy and policies through independent, constructive and informed comments.” (HKEX, Rules en Guidance C.1.7).

2. Board Composition and Gender Diversity

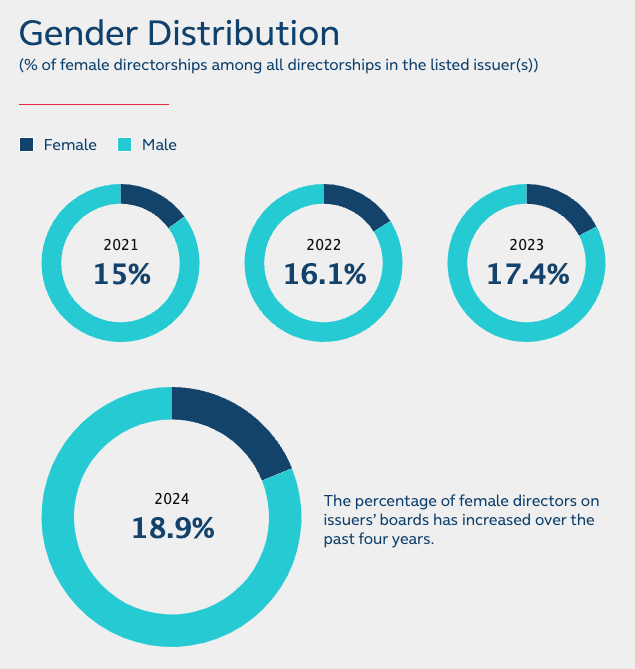

Gender diversity remains a persistent challenge in Hong Kong’s board composition. Nearly 57% of students enrolled in business and management courses are female and women hold over half of entry-level positions. However, their representation decreases as they progress up the corporate ladder. In the financial sector, women occupy only a third of senior management roles. More concerning is their presence in board composition, where women currently hold just 18.8% of directorships among Hong Kong-listed companies as shown in Figure 1.

This disparity highlights the urgency of addressing gender diversity on boards. This is why another key regulatory change is the HKEX's mandate requiring all-male boards to appoint at least one female director by December 2024. It is a part of the broader efforts to improve gender diversity in corporate governance.

By December 2024, Hong Kong’s firms are expected to show substantial progress in enhancing gender diversity on their boards. This shift aims to create a more balanced and inclusive corporate environment, offering equal opportunities for aspiring leaders of all genders. As companies work to meet these targets, the hope is that boards will reflect a fairer and more equitable landscape, ensuring that leadership roles are accessible to talent from diverse backgrounds, ultimately contributing to stronger governance and decision-making processes.

Rethinking Independence

While the major issues have been discussed, independence among INEDs remains a taboo. A problem that was recently observed by shareholder activist David Webb is that “About 90 per cent of Hong Kong-listed companies have controlling shareholders, and these controllers vote to elect the INEDs, so they are only as independent and competent as the controlling shareholders want them to be.” Therefore, to prevent CEOs or significant shareholders from controlling too many governance decisions, HKEX stipulated that listed companies must maintain a specific ratio of INEDs. Furthermore, they have proposed a limit of a nine-year maximum tenure for INEDs aims to address concerns that long-serving directors may lose their independence over time.

Future Developments

On top of the restrictions on overboarding and term limits, and the drive towards improved diversity, there are other developments that may impact the selection of INEDs.

ESG disclosure requirements continue to become more complex and, as a result, the risk factors for organisations increase in parallel. Once regulators begin enforcing on non-compliance, there will be a driver to manage this risk at board level. The more progressive companies who are placing sustainability at the core of their businesses may also look to ensure this knowledge is represented on the board to ensure long-term investments in this space are supported.

Whilst technology has always had an agenda slot, it is likely that the convergence of data, security and AI/machine learning will bring a unique context to managing risks that may need to be more directly represented by knowledgeable individuals on corporate boards.

Conclusion

We observe that across listed and privately owned organisations, board structures, strategy and recruitment are handled in an inconsistent manner. The appointment of new board members should be an ‘arm’s length’ process with a clear definition of the skills and profile needed to create balance and a wide funnel of potential candidates reviewed against these criteria. This is not always the case with referrals for open positions occurring within a closed network.

We also see a lack of talent ‘liquidity’ in both the corporate and NGO sectors. There are candidates interested in both paid and volunteer board and advisory roles but no way of seeking these positions in a centralised way.

To try and resolve this issue, we launched a Board & Advisory talent pool as our first initiative on our ConnectedTalent platform. The platform enables employers to search for talent based on skills and industry experience and candidates to opt in/out of different types of roles. Access will remain free to nonprofits as part of our social purpose and will ultimately be a paid service for corporates. We are currently building the candidate base (register here) and will open in beta mode to employers in January 2025. Employers may register their interest here in advance to be notified.

To discuss board strategy and recruitment, feel free to contact Mathew Gollop, Managing Director at ConnectedGroup – mat@connectedgroup.com

Article by Raphael Deren and Mathew Gollop

Share This Blog

Recent Articles